As per the rudimentary laws of economics if the demand for USD in India exceeds its supply then its worth will go up and that of the INR will come down in that respect. It may be that importers are the major entities who are in need of the dollar for making their payments. Another possibility here could be that the Foreign Institutional Investors are withdrawing their investments in the country and taking them elsewhere.

This can create a shortfall in supply of the dollar in India. In fact, of late, the FIIs have been heading to greener pastures like Singapore owing to the greater operational efficiency and lesser bureaucratic problems that have unsettled the Indian business fraternity and hampered its overall economic growth.

This situation can only be addressed by exporters who can bring in dollars in the system. If somehow the FIIs can be wooed back, then this imbalance can also be addressed to a certain extent.

Price of crude oil

The worth of crude oil has been a major bane for India since it has to bring in the majority of its requirement from outside the country. The demand for oil in India has been going up every year and this has led to the present situation. All over the world, the price of oil is given in dollars. This implies that as and when the demand for oil increases in India or there is an increase in oil prices in the global market, there also arises a need for more dollars to pay the suppliers. This also results in a situation where the worth of the INR decreases significantly in comparison to the dollar.

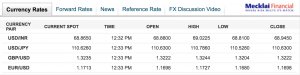

Performance of dollar with respect to other currencies

The central banks across Japan and countries in the Eurozone have been bringing out a lot of money and this has meant that both Yen and Euro have lost their value. Compared to this the US Federal Reserve is giving hints that it will end the fiscal stimulus so that the dollar becomes stronger with respect to other currencies such as the Indian Rupee at least for the time being.

Volatility in the equity market

The equity markets in India have been volatile for a certain period of time. This has put the FIIs into a dilemma as to whether they should be investing in India or not. In recent times their investments have touched an unprecedented level and so if they pull out then the inflow will go down as well.

Effects of equity market problems on investors

Now if the INR becomes weak then it will affect the investors who are putting their money in India. For the first time ever since 2016 the FIIs have been reduced to net sellers of debt based securities. The main reason behind this is the present state of the INR. The expenses incurred in hedging the unpredictable INR are reducing the yield differential that is the main area of profit for these investors.

India, in fact, is not the only emerging market where the currency has taken a hit. The situation is similar in countries like Indonesia, Brazil and Thailand. The bond markets in several countries like India are also taking a hit as the FIIs are withdrawing en masse. The exchange traded funds are also being redeemed as the global business fraternity is looking to cut down on risks.

Poor current account deficit

One of the main reasons behind the Indian government’s inability to arrest the fall of the national currency is the critical current account deficit. In the 2012-13 fiscal India’s CAD was measured at ~2 per cent of the GDP. The government has been unable to come up with any new destinations for exporting its products and this has also hampered the growth in this sector. There are other crucial reasons here like the lack of one window for clearance purposes and procedural delays. Even areas where India has traditionally done well on this front have fared badly this time around.

Condition of import bill

India’s import bill has been going up of late and most of this can be attributed to gold. This has also hampered India’s efforts to arrest the slide of the INR. Gold alone takes up more than 10 per cent of India’s import bill. The government took some measures that restricted gold imports to 31 tons during June but once again in the first few days in July the imports went up to 45 tons.

Contraction of Indian economy

The various important sectors of Indian economy such as manufacturing, mining and agriculture have seen poor growth in 2018 and this has made them less appealing propositions for the investors. During June 2018, the aggregate industrial production in India reduced by 2.2 per cent and in July 2018 the RBI predicted that in the present fiscal there would be a growth of 5.5% which was lesser than its previous prediction of 5.7%.

Future prospects of INR

In spite of all that has been said above it will be foolish to write off the INR completely and say it shall not rise from the mire. Experts are saying that the government needs to take some short and medium term steps that will help the economy get back on its feet yet again. It is only through continued efforts that the Indian government will be able to retrieve the situation. However, it will take a Herculean effort to help the INR get back to the 60 mark.

Source : Economic Times